It is simple, when the 50 day moving average is rising, we give the benefit of doubt to buyers. It doesn’t mean we blindly buy pullbacks or fail to recognize when conditions appear to be dangerous. It also means that we don’t call for a top every time we see the markets pull back a few percent. Our job is to listen objectively to the market to recognize low risk opportunities when they reveal themselves to us and to manage risk on existing positions. That job is always the same, regardless of the headline of the day.

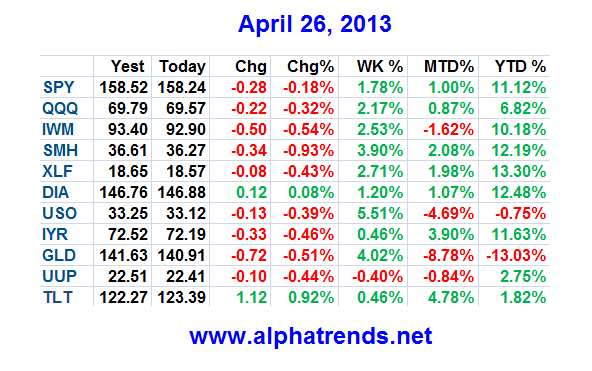

The video below takes a look at trends and key levels to be aware of in $SPY $QQQ $IWM $XLF $SMH $AAPL $TSLA Have a great weekend!

~Brian