Whether you are a seasoned investor or just getting started, we have the resources and expertise you need to succeed in today’s dynamic markets. It’s time to elevate your trading game and seize the profits you deserve.

- A 30-year expert trader, thought leader, and author of two best-trading books, Brian Shannon will take you through trade set-ups using the Anchored VWAP.

- Brian Shannon offers a range of services to help make informed trading decisions, from daily market insights to one-on-one coaching sessions.

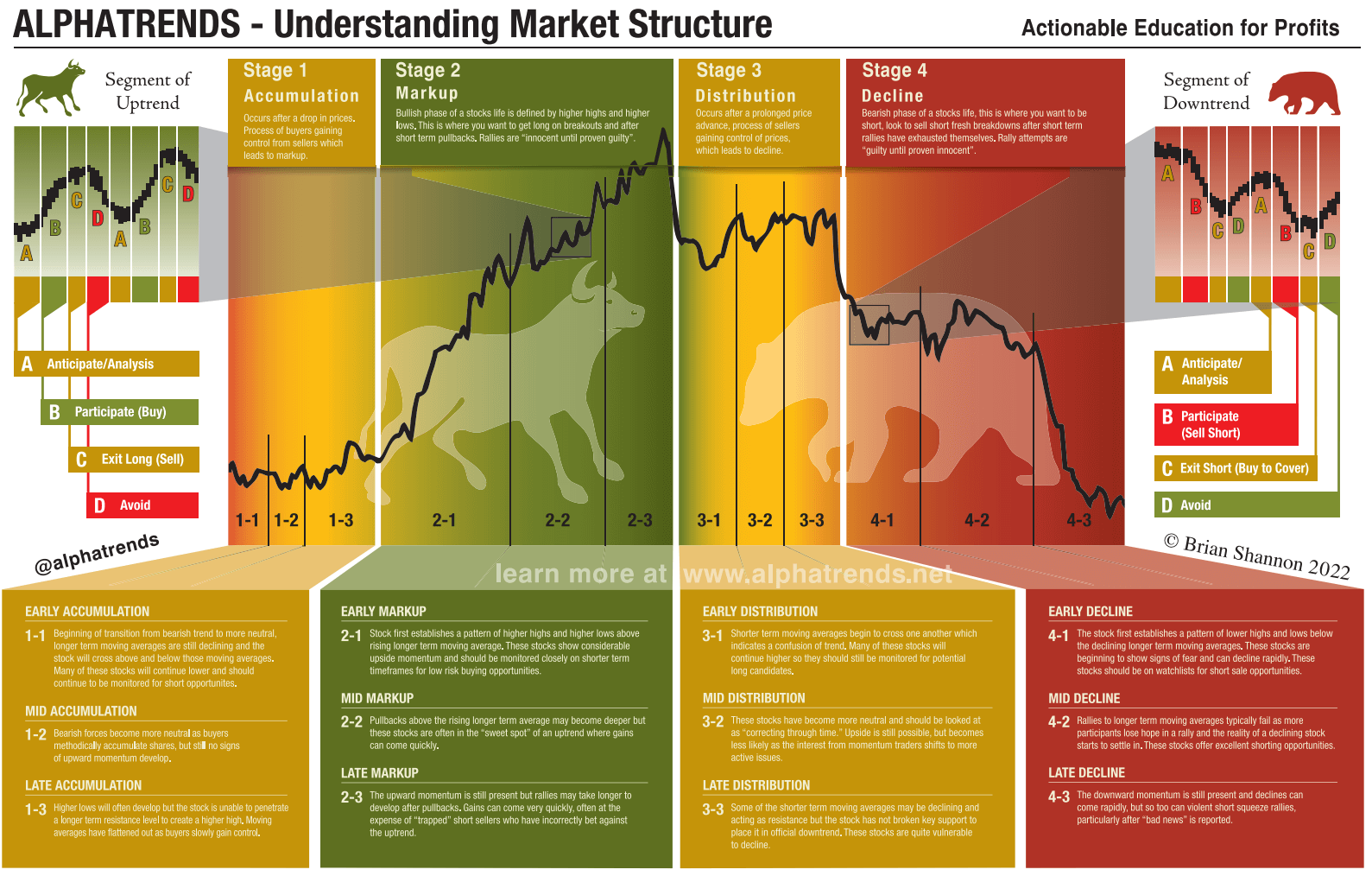

- The trading concepts, timing your entry and exit, and minimizing risk all work on timeframes. The trading ideas and examples given by Brian will primarily focus on the swing trading timeframe.